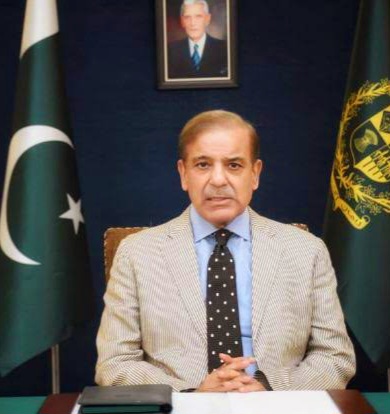

Muhammad Aurangzeb as Finance Minister of Pakistan announced procedures which target tax method simplification for wages earners to decrease their tax obligations. During a Senate Finance Committee gathering which Senator Saleem Mandviwalla chaired the minister explained how government officials intend to create a streamlined taxation method without unnecessary complexities.

The current state of Pakistan involves active participation in a medium-term IMF program while scheduling February meetings with all relevant stakeholders. At the beginning of the new fiscal year the policy will detach from Federal Board of Revenue (FBR) while actions will be implemented to decrease taxation on people receiving salaries.

The Finance Minister emphasized that super tax only affects 30 percent of the population while the number is closer to 60 percent and his team works to simplify taxpayer forms for the salaried community. Additionally he stated that the government is constructing a 10-year investor plan centered around capacity building which used to receive minimal attention.

According to Aurangzeb the super tax exemption applies to most of the salaried population which the government aims to develop both an equal and streamlined tax approach that promotes economic development without imposing further strain on taxpayers.