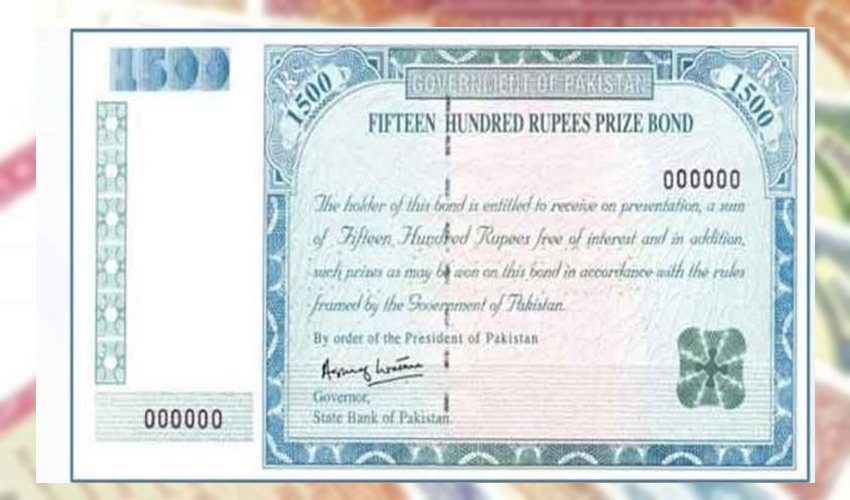

ISLAMABAD: The Government of Pakistan has announced an increase in the withholding tax rates applicable to winnings from prize bonds and profits earned on loans. The revised rates will be uniformly applied to both tax filers and non-filers across the board.

According to a notification issued by the relevant authorities, tax filers who win prize bonds will now be subject to a 15 percent withholding tax on their winnings. Conversely, non-filers will face a significantly higher withholding tax rate of 30 percent on prize bond winnings.

Similarly, the new tax structure also impacts profits derived from loans. For tax filers, a 15 percent withholding tax will be levied on such profits. Non-filers, however, will be subject to a 30 percent withholding tax on their loan profits.

This move is part of the government’s broader strategy to enhance tax collection and broaden the tax net. While the increased rates are expected to boost national revenue, analysts suggest they could potentially influence investment patterns in prize bonds and certain loan-based financial products. The revised tax rates are effective immediately.