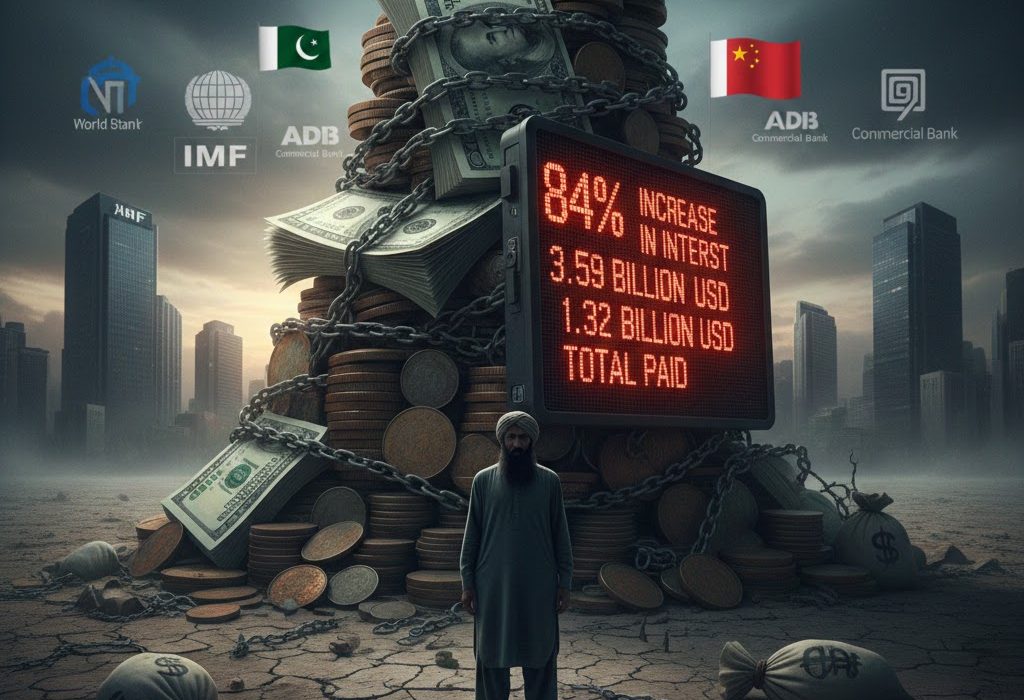

A recent report by the Economic Affairs Division has presented a clear picture of Pakistan’s debts, which shows how the country is entangled in a debt trap. According to the report, Pakistan paid a total of $13.32 billion in interest and principal last year. Despite paying this huge amount, Pakistan’s total debt is increasing instead of decreasing. The document shows that Pakistan’s net external debt has increased by $1.71 billion in the last year, which is mainly due to the acquisition of new loans.

The 84 per cent increase in interest payments is close to the highest level in the country’s history. Compared to three years ago, $3.59 billion is now being paid in interest. This is the amount that Pakistan could have spent on education, health and public welfare, but it is now going into the pockets of international financial institutions. An important revelation in the report is that friendly countries like China and Saudi Arabia have also received interest on their safe deposits. There is a general impression among the public that deposits of friendly countries are interest-free, but the figures tell a different story.

Pakistan has repaid about $9.73 billion in debt in the last three years but at the same time signed new loan agreements worth $10.64 billion. This means that we take on more new debt than we repay. Economists believe that unless interest rates and the terms of new loan agreements are relaxed, Pakistan’s financial independence will remain at risk. The government should attract foreign investment to minimise dependence on debt.